Industry Standard Policies and Tools

Documents

ALTA Outgoing Wire Preparation Checklist

Use this checklist as a best practice for verifying outgoing wire information.

Word Doc | PDF

ALTA Rapid Response Plan for Wire Fraud Incidents

Use this tool to customize your action plan when a wire fraud attempt occurs.

Word Doc | PDF

How to Complete an IC3 Report

Watch the video to learn how simple it is to assist law enforcement in gathering information.

ALTA Cybersecurity Incident Response Plan: Use this tool to help your team to establish and maintain secure systems and be prepared to act quickly if an incident occurs. Leverage these resources to implement Step 1: Preparation:

- ALTA Cyber System Overview: Use this narrative to improve your understanding of a Cyber System Inventory, why it is important to Cybersecurity efforts, and how to create and maintain your company's inventory.

- ALTA Cyber System Inventory Workbook: Use this model workbook to create and customize your company's inventory.

- ALTA Business Impact Analysis: Use this guide to examine your software applications, determine which resources are critical to your operation, and discover when to add resources to minimize the business impact of downtime.

Resources for Your Clients and Consumers

ALTA Wire Fraud Tips

(consumer video)

Protect Your Money from Wire Fraud Schemes

(consumer video)

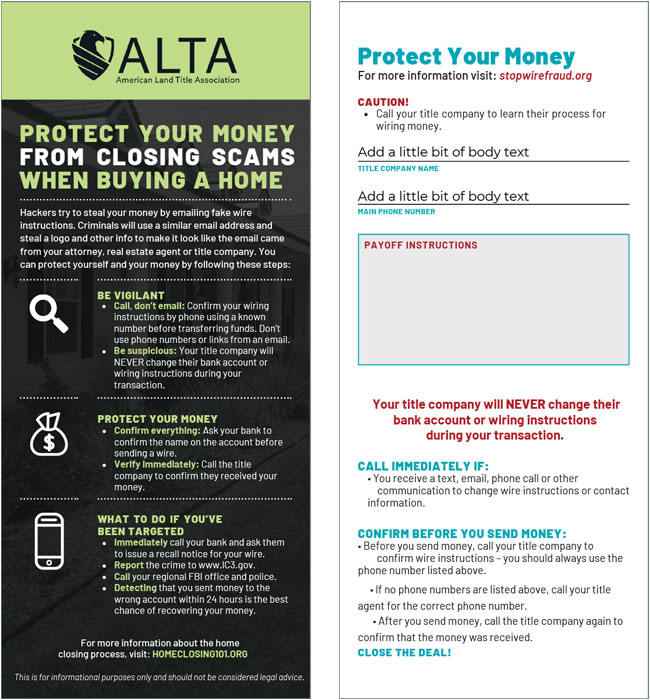

ALTA Wire Fraud Rack Card

ALTA has produced this Rack Card explaining Wire Fraud. ALTA Members can brand the infographic with their own information at the ALTAprints website. This rack card can also be branded in 14 different languages.

ALTA has produced this Rack Card explaining Wire Fraud. ALTA Members can brand the infographic with their own information at the ALTAprints website. This rack card can also be branded in 14 different languages.

What is Phishing/Wire Fraud PowerPoint (Member-only content)

Use this presentation to educate consumers about the dangers of phishing emails and wire transfer fraud. The presentation provides information on what to do if you’ve fallen victim to a scam and also highlights 10 tips to prevent wire fraud.

Use this presentation to educate consumers about the dangers of phishing emails and wire transfer fraud. The presentation provides information on what to do if you’ve fallen victim to a scam and also highlights 10 tips to prevent wire fraud.

Employee Training and Awareness

ALTA Insights Webinars

ALTA Webinars provide access to industry experts and the latest information about information security topics. Visit the Link to the ALTA Insights Webinars to learn more.

Monitor and Improve Employee Skills

Consider a phishing security test for all of your employees. These companies can help:

- Security Planner: https://securityplanner.org

- PhishMe: https://phishme.com/free

- KnowBe4: https://www.knowbe4.com/resources

Information Security Articles

Recent 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014

Title Companies Fighting Cybercrime to Protect the American Dream

Recognizing the gravity of the threat of cyberattacks, the title insurance industry has taken decisive steps to combat wire fraud, protect consumers and ensure the integrity of real estate transactions. ALTA CEO Diane Tomb shares the array of tools title companies utilize—in conjunction with consumer education and staff training—to combat wire fraud.

Strategies to Combat Wire Fraud

In 2012, former FBI Director Robert Mueller opined, “There are only two types of companies: those that have been hacked and those that will be.” That statement rings true 13 years later. Today, wire fraud remains one of the most pressing threats facing title and escrow companies. Fraudsters are becoming increasingly sophisticated, leveraging business email compromise, seller impersonation and even deepfake technology to infiltrate transactions. As the threats have escalated, the types of strategies criminals use to steal funds continue to evolve. This highlights the importance of continuous training, robust verification processes and industry collaboration to protect businesses and consumers from financial loss.

FBI: Cybercrime Losses Hit $16.6 Billion in 2024

Fraud and ransomware were the top schemes that resulted in record losses of $16.6 billion in 2024, according to the FBI’s 2024 Internet Crime Report. The report also provides losses due to business email compromise, real estate fraud and identity theft. Read on for details.

Mapping Out Elements of a Robust Cybersecurity Implementation Program

The purpose of a cybersecurity plan is threefold: to ensure the security and privacy of sensitive customer data, to meet the strict regulatory requirements that exist to protect customers from fraud and ensure fair transactions, and to build and maintain client trust through appropriate risk management protocols. Read on for key steps to consider when establishing a strong cybersecurity program.

Phishers Disguise Attacks Inside SharePoint to Wreak Havoc

Hackers are getting creative to spread danger attacks. Their latest trick involves using Microsoft SharePoint. By disguising their phishing scams as legitimate SharePoint documents, criminals can sneak past security measures and put both individuals and companies at risk. Genady Vishnevetsky, chief info security officer for Stewart Title Guaranty Co. and chair of ALTA's Information Security Work Group, details how the attack is carried out, and provides tips to help thwart these attacks.