Blockchain Can’t Protect Property Rights, but Title Insurance Can

April 19, 2018

By Zachary Kammerdeiner and Ashley Sadler

It’s hard to open a newspaper today (or, more accurately, scroll through the news) without seeing an article about blockchain. This new technology is taking our society by storm with many touting its wide-ranging benefits. There are potential applications of blockchain technology that touch the title insurance industry, including, but not limited to, land recording systems. Enthusiastic proponents argue that these systems would be so efficient and secure that they would eliminate the need for title insurance. However, this argument ignores the fundamental purpose of title insurance: to protect a homeowner against undiscovered title issues and provide assurances of property rights. Blockchain technology will not replace title insurance; rather, it will ensure that the title insurance industry will endure.

The Basics of Blockchain

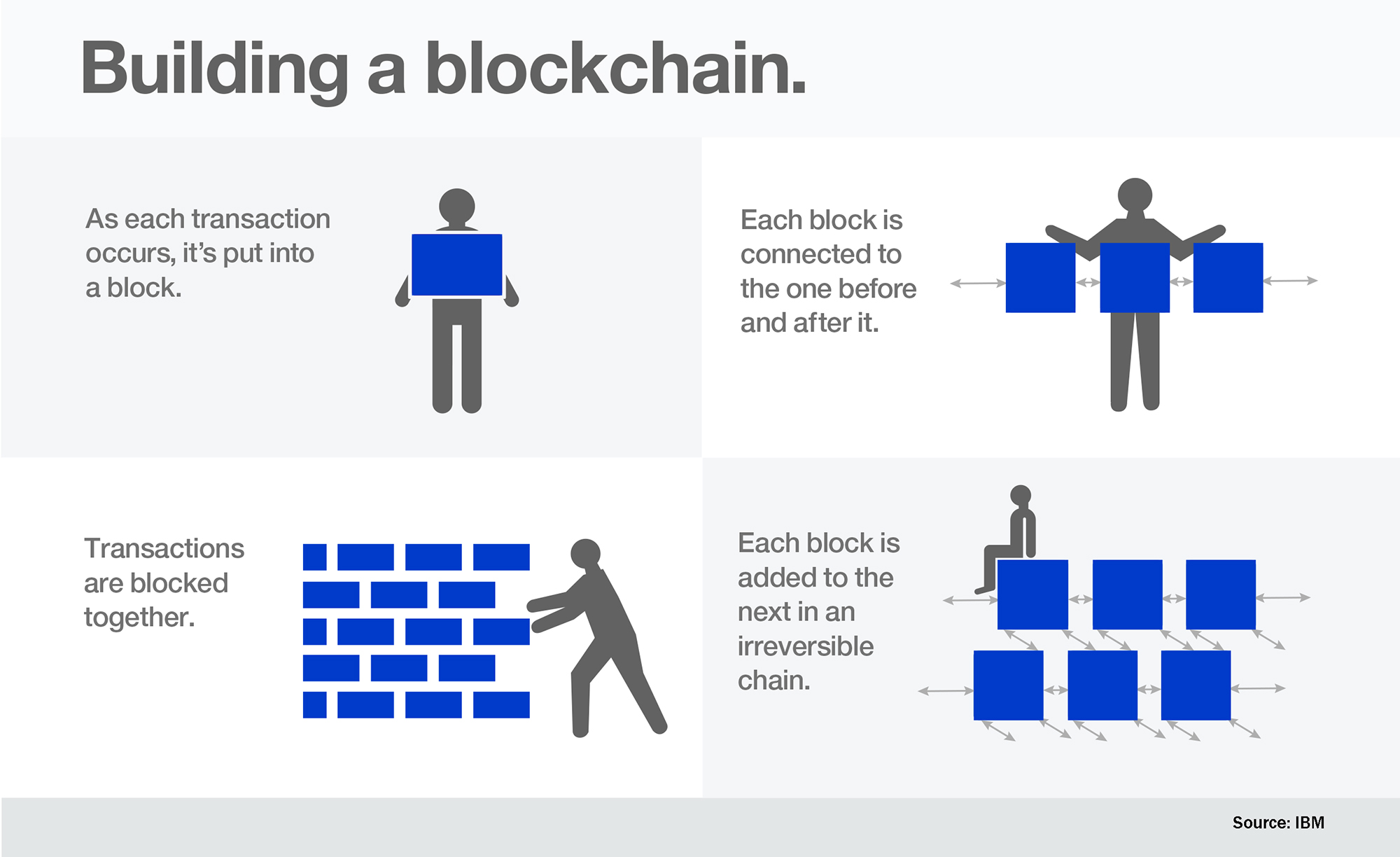

At a most basic level, blockchain is like a database. How it functions, however, is more complicated. Blockchain utilizes distributed ledger technology to store data, meaning that the data “on the chain” (in blockchain community parlance) is shared by thousands of nodes across a network. This means that no one source holds the database, but rather it is held by each “node” (think: computer) in the network. When a transaction is executed, the information that forms the transaction is held on a “block” that is connected to other related transactions through unique digital fingerprints, called “hashes.”

Luckily, much like how few of us know the complexities of our car’s engine, there is not a need for all of us to understand the intricate mechanisms that underlie the blockchain. What is helpful for most of us to understand is why blockchain may provide solutions to some of the biggest issues plaguing our society, but it is also important to keep in mind the limitations of this new technology.

Applying Blockchain to the Title Insurance Industry

There are many current functions relative to land transfers that a blockchain cannot perform. In a real property conveyance, there are a multitude of parties necessary to ensure a seamless transaction. Real estate agents, loan officers, title insurance professionals and real estate attorneys are all integral to the settlement process in the United States. Each party provides specialized knowledge that helps ensure the buyer and seller are getting the deal they want.

Perhaps the community within the real estate industry that would be affected most by the application of blockchain technology is the title insurance industry. Some have argued that the implementation of blockchain technology will diminish the need for title insurance. Such a belief points to an inherent misunderstanding of what title insurance is and the protections it provides.

Necessity for a gatekeeper

Implementing a blockchain land registry system will not replace the need for human oversight. Much like there is currently the need for a town or county clerk to review documents submitted for recording in a traditional land registry, there will be a similar need for such a party to review documents submitted to a blockchain land registry. This gatekeeper will need to perform similar functions as town or county clerks perform today, including reviewing documents to ensure they conform with state and local requirements and to ensure that no non-public, personal information (such as social security numbers) is included in any document submitted for recording.

While blockchain has the ability to promote efficient and more transparent title searches, the benefits of the blockchain are only as good as the data provided to it. As detailed in a blockchain study conducted by the state of Vermont, “blockchain technology offers no assistance in terms of reliability or accuracy of the records contained on the blockchain; if bad data is used as an input, as long as the correct protocols are utilized, it will be accepted by the network and added to the blockchain.” Thus, while the blockchain helps to ensure that the data retained has not been tampered with, it offers no protection against the recording of incorrect or inaccurate data.

Not only does this limitation of blockchain necessitate a gatekeeper to keep intrinsically bad data off the blockchain, it also requires the expertise of title insurance professionals to perform the title review functions commonly practiced today.

Insurable risks will still exist

What happens when a gatekeeper does not prevent bad data from being recorded on the blockchain? In the title insurance industry, we often deal with that very situation today. Any title insurance underwriter can attest to the fact that human error generates more underwriting calls from our agents than anything else. Typos in parties’ names, omission of a property description in a deed, and ineffective notarial clauses are all examples of common “garbage in, garbage out” dilemmas that affect the integrity of property records today, and which would plague a blockchain ledger. Some in the blockchain community wonder whether data integrity is the technology’s Achilles Heel. While it is possible that technology may provide solutions for some of the specific types of human error that lead to bad data being recorded on the blockchain, such errors will never be fully eliminated as long as people are involved in the process. The title insurance industry will continue to insure against these risks as we always have.

There are many other risks that are not conspicuous in a land registry that call a recorded real estate title transaction into question. For example, in a judicial foreclosure state such as Connecticut, procedural legal errors made by a party in a foreclosure lawsuit can render a title unmarketable. Failing to name lienholders as defendants could result in a buyer purchasing real estate that is still encumbered by outstanding liens at the foreclosure auction. In the business, we call these issues “off-record” title defects—meaning defects that arise by events unobservable from the land records.

Some blockchain developers claim that their technology will eliminate the need for title insurance. However, it is difficult to imagine how a digital ledger could identify the foreclosure defect in the example above. Title insurance agents and underwriters will continue to be on the front lines identifying these risks in the years to come, regardless of whether blockchain technology is implemented in the future.

If insuring real estate titles over the past century and a half has taught the industry anything, it would be that risks are constantly evolving as conveyancing practices and requirements change. If full-scale implementation of blockchain technology occurs, it may eventually change the way that title insurance is provided to our customers. However, it will be just like any other development that has affected property rights throughout history. The flaws that exist in the system will be the lifeblood of new categories of risk that we cannot imagine today. The title insurance industry will likely be called upon to insure over such risks. We will answer the call.

What title insurance can do that blockchain can’t

Typically, purchasing a home is the largest investment a person will make in his or her lifetime. A homebuyer’s lender acquires a stake in the home as well. A title insurance policy is the only way to protect a homebuyer’s and a lender’s investment against another’s claim of ownership in the property, as well as a host of other title defects. Title insurance helps to provide the homebuyer and lender with peace of mind knowing that they will not be required to pay certain existing debts or resolve covered legal problems related to the home following the closing.

When a homebuyer or a lender suffers a covered loss, the title insurer pays or settles the claim.

The title insurance industry paid approximately $739 million in total claims in 2017. Can blockchain technology make whole a homebuyer or a lender who suffers a title loss? No, but the title insurance industry can.

Moreover, the unique way in which title insurance coverage operates—protecting against undiscovered title issues that arose in the past—creates an incentive for underwriters and title agents to resolve title problems prior to closing and issuing a title policy. This process has resulted in cleaner land recording systems in the United States, which has been recognized as one of the reasons for the success of the U.S. economy throughout the country’s history. Embracing blockchain technology in land registries will not provide means for paying claims. Thus, the title insurance industry will continue to play our important role in the health of the United States economy if and when blockchain technology is adopted.

Conclusion

Blockchain technology holds infinite possibilities that could help make current processes in our industry and society more efficient; however, it will never be able to do what title insurance professionals do each day: provide peace of mind and protect property rights. Homeowners and lenders have relied on our services for generations. Emerging technologies will not replace the assurances that title insurance provides.

Zachary Kammerdeiner is title counsel in CATIC’s Rocky Hill, Conn., office, and Ashley Sadler is business and compliance strategist for CATIC. The authors acknowledge the assistance of James M. Czapiga, president and CEO of CATIC; and Reese Lacasse, Jason Blair and Steve Gallichio, all of CATIC’s IT Department.

Contact ALTA at 202-296-3671 or [email protected].