In May 2024, the American Land Title Association (ALTA) and ndp | analytics conducted an online survey to better understand seller impersonation fraud (SIF) and the industry's experience with successful and unsuccessful attempted SIF. The survey received 783 responses from the broader title insurance community across 49 states and the District of Columbia.

The key findings are:

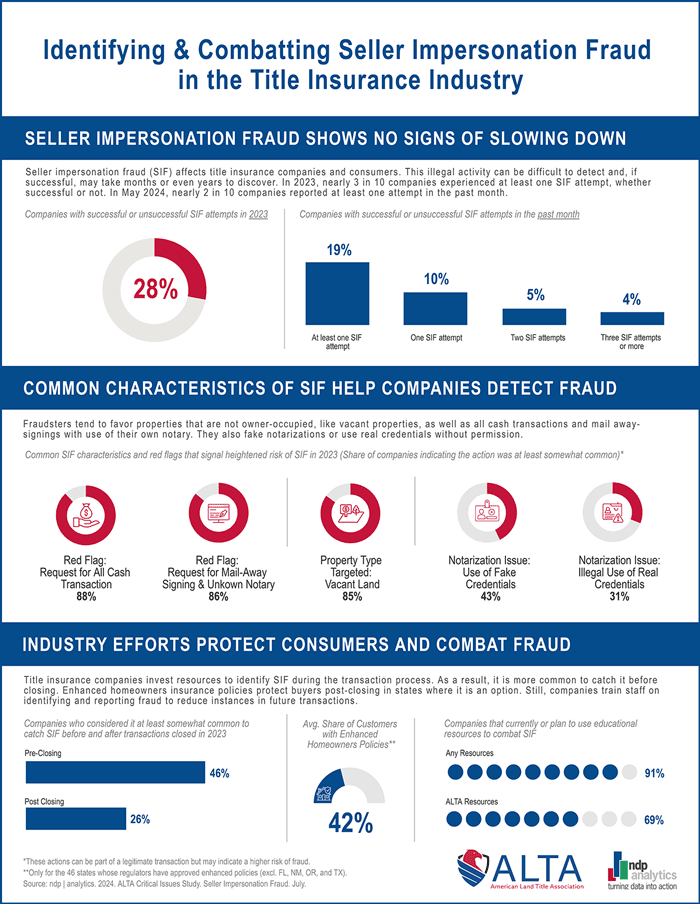

- SIF is a growing problem. 28% of title insurance companies experienced at least one SIF attempt last year; 19% faced attempts in April 2024 alone.

- Common characteristics of SIF included notarization issues and use of the property owner’s legitimate non-public personal information.

- While not always considered unusual, some factors that can be SIF red flags include vacant land transactions, requests for use of an unknown notary, and all cash transactions.

- In 2023, SIF was most often caught before the closing was completed. For SIF identified post-closing, buyers can be protected by title insurance; enhanced policies also cover forgery in the future.

- The vast majority of title insurance companies have adopted tools and resources to fight SIF.