How to Disclose Flood Insurance on Loan Estimate and Closing Disclosure

June 14, 2017

The Consumer Financial Protection Bureau (CFPB) held a webinar April 12 to address frequently asked questions about the TILA-RESPA Integrated Disclosures (TRID) rule. One of the questions addressed was how to show flood insurance premiums on the Loan Estimate and Closing Disclosure.

Click here to access the webinar recording. Click here to access recordings of the CFPB’s previous webinars on the integrated disclosures.

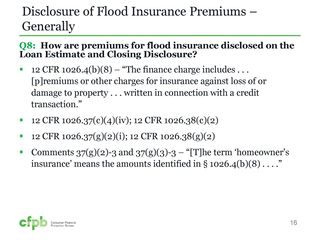

The CFPB staff stated that the term “homeowner’s insurance” as used under the rule includes flood insurance. Specifically, the CFPB staff stated that “homeowner’s insurance” under the rule means, “the amounts identified in § 1026.4(b)(8), which include premiums for insurance against losses or damage to property written in connection with the credit transaction.

The CFPB staff stated that the term “homeowner’s insurance” as used under the rule includes flood insurance. Specifically, the CFPB staff stated that “homeowner’s insurance” under the rule means, “the amounts identified in § 1026.4(b)(8), which include premiums for insurance against losses or damage to property written in connection with the credit transaction.

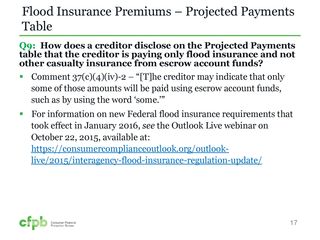

As such, flood insurance is treated under the rule, and more generally under Regulation Z, as other casualty insurance, such as homeowner’s insurance.” CFPB straff noted that flood insurance may be disclosed on the forms under the Estimated Taxes, Insurance and Assessments in the Projected Payments table in the Homeowner’s Insurance line. Tthe box for Homeowner’s Insurance would be checked, and Yes or No would be indicted to state whether it is escrowed, according to the webinar. In addition, in the Projected Payments table, the Escrow amount would include any amount escrowed for flood insurance.

Under the Prepaids section in Other Costs, if there is any amount that is prepaid for flood insurance, it would be disclosed on the Homeowner’s Insurance line Section F along with any other prepaid amount for the homeowner’s insurance premium. Under the Escrow section in Other Costs, if any flood insurance premiums are in escrow, they would be disclosed on the line for Homeowner’s Insurance in Section G.

Under the Prepaids section in Other Costs, if there is any amount that is prepaid for flood insurance, it would be disclosed on the Homeowner’s Insurance line Section F along with any other prepaid amount for the homeowner’s insurance premium. Under the Escrow section in Other Costs, if any flood insurance premiums are in escrow, they would be disclosed on the line for Homeowner’s Insurance in Section G.

According to Richard Horn of Richard Horn Legal PLLC, the CFPB noted that the flood insurance payments would be reflected in the Escrow tables on page four of the Closing Disclosure, “but they did not explicitly state how it would be referred to (i.e., as Homeowner’s Insurance or Flood Insurance).”

“In addition, this answer does not address how to disclose the payee and the term in the Prepaids section or the amount of months collected in the Escrows section for Flood Insurance if this information is different from the hazard insurance policy,” Horn added.