CFPB Says Owner’s Policy May Be Disclosed as Negative Number Under TRID

April 15, 2016

During a webinar on April 12, the Consumer Financial Protection Bureau addressed several questions regarding the TILA-RESPA Integrated Disclosures (TRID) rule that stakeholders have submitted in recent weeks, including the disclosure of fees for owner’s title insurance.

The CFPB specifically addressed this question submitted by ALTA during the webinar:

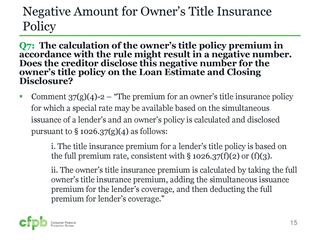

The calculation of the owner’s title policy premium (in a purchase transaction when owner’s and lender’s policies are issued simultaneously) in accordance with the rule might result in a negative number. Does the creditor disclose this negative number for the owner’s title policy on the Loan Estimate and Closing Disclosure?

Dania Ayoubi, counsel in the CFPB’s Office of Regulations, said that in this situation, the creditor would disclose the premium for the owner’s policy as a negative number.

“When a simultaneous issue rate or discount is used—mostly in purchase transactions—the cost of an owner’s title insurance policy is disclosed as the incremental cost of that owner’s title insurance beyond the standard non-discounted cost of the lender’s title insurance policy,” Ayoubi said. “When disclosed in this fashion, the disclosure conveys to the consumer that it is less expensive to purchase both owner’s title insurance and lenders title insurance together than it is to purchase just lenders policy by itself.”

She referenced Comment 37(g)(4)-2 of the rule, which states “The premium for an owner’s title insurance policy for which a special rate may be available based on the simultaneous issuance of a lender’s and an owner’s policy is calculated and disclosed pursuant to § 1026.37(g)(4) as follows:

- The title insurance premium for a lender’s title policy is based on the full premium rate, consistent with § 1026.37(f)(2) or (f)(3).

- The owner’s title insurance premium is calculated by taking the full owner’s title insurance premium, adding the simultaneous issuance premium for the lender’s coverage, and then deducting the full premium for lender’s coverage.”

Ayoubi said the CFPB previously addressed how these premiums should be calculated and disclosed in the May 2015 webinar. She added that there are no provisions in Regulation Z that would prohibit the cost of owner’s title insurance from being disclosed as a negative number.

ALTA issued a release last week reminding the CFPB that the way the rule requires the disclosure of premiums for an owner’s policy is not “transparent,” “practical” or “accurate” as the bureau believes and is inconsistent with the Bureau’s mission to better inform consumers.

Other topics covered included:

- General principles

- APR

- Title Interest Percentage

- Flood insurance premiums

- Escrow accounts for refinance transactions

- Separate disclosures (borrower’s and seller’s information, creditor’s copy, seller’s Closing Disclosure, seller-paid costs, seller-paid real estate commissions)

- Assumptions

- Property taxes

- Fees collected prior to consummation

- Calculating cash to close—loan amount

- Principal curtailments

- Construction lending—interest reserve

Click here to access the entire presentation from the April 12 webinar. The format of the webinar was similar to previous webinars the CFPB has provided. Click here to view previous webinars.

Others participating on the webinar from CFPB’s Office of Regulations included Seth Caffrey, counsel; Kristin Switzer, regulatory implementation analyst; Alexa Reimelt, counsel; and Chelsea Peter, counsel.

CFPB staff reminded listeners that the webinar is not a substitute for the rule. Only the rule, including its amendments and official commentary, can provide complete and definitive information regarding the Rule’s requirements, according to the CFPB.

As a general rule, the CFPB presenters indicated that when determining how to comply with the rule, one should first search the rule to see if it specifies how to comply. Absent any specific guidance, one can disclose as he or she thinks is appropriate, as long as that method of disclosing is not prohibited by the rule. The main takeaway was that there are oftentimes several ways of disclosing a fee, any one of which may be acceptable under the rule. This approach reiterates ALTA's message that members need to communicate with their lender partners to determine how fees will be disclosed.