Featured Resources

ALTA Insights Webinar

ALTA Insights Webinar

TRID Ready? This Is What It Looks Like

Watch this webinar to learn the initial perceptions of the then-new TRID rule. The presenters cover the lender Perspective, Title/Settlement Agent Perspective, Technology, What Your Real Estate Partners Should Know and What Consumers Should Know.

TitleNews Article

TitleNews Article

CFPB Releases Findings From TRID Assessment Report

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires the Consumer Financial Protection Bureau to review some of its rules and issue reports within five years after they take effect. In November 2013, the bureau issued its final TILA-RESPA Integrated Disclosures Rule rule, which went into effect Oct. 3, 2015.

HR Document

HR Document

TRID Preparedness Checklist

Title agents can use this checklist to make sure their IT equipment is ready to handle the TRID upgrade.

Policy + Tools

TRID Final Rule for Integrated Mortgage Disclosures

Read the entire rule from the Consumer Financial Protection Bureau (CFPB). The rule is effective August 1, 2015.

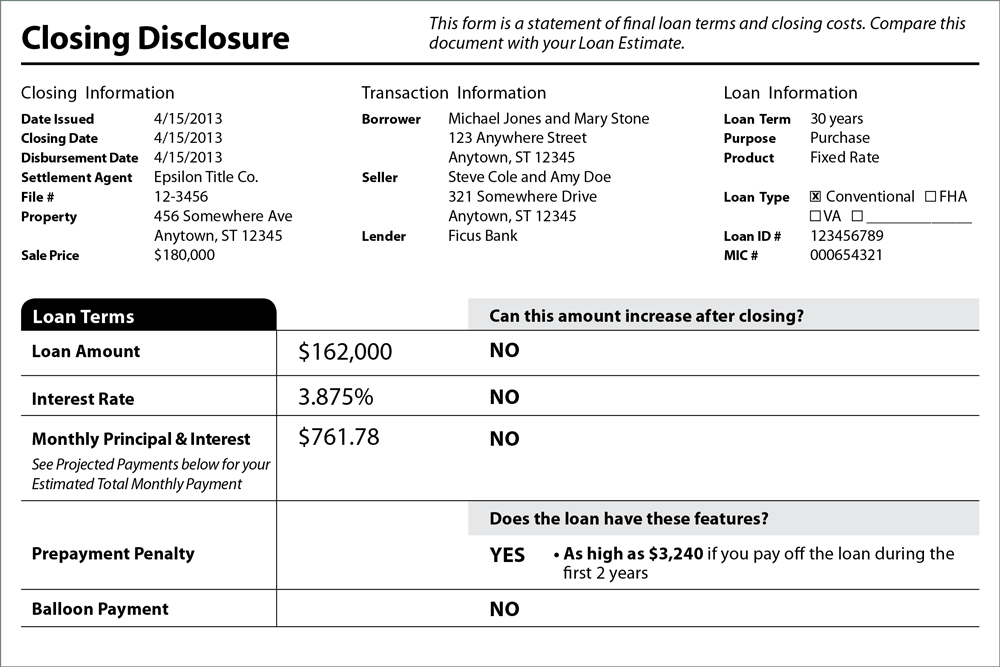

Closing Disclosure Example

Lenders are required to provide your Closing Disclosure three business days before your scheduled closing.

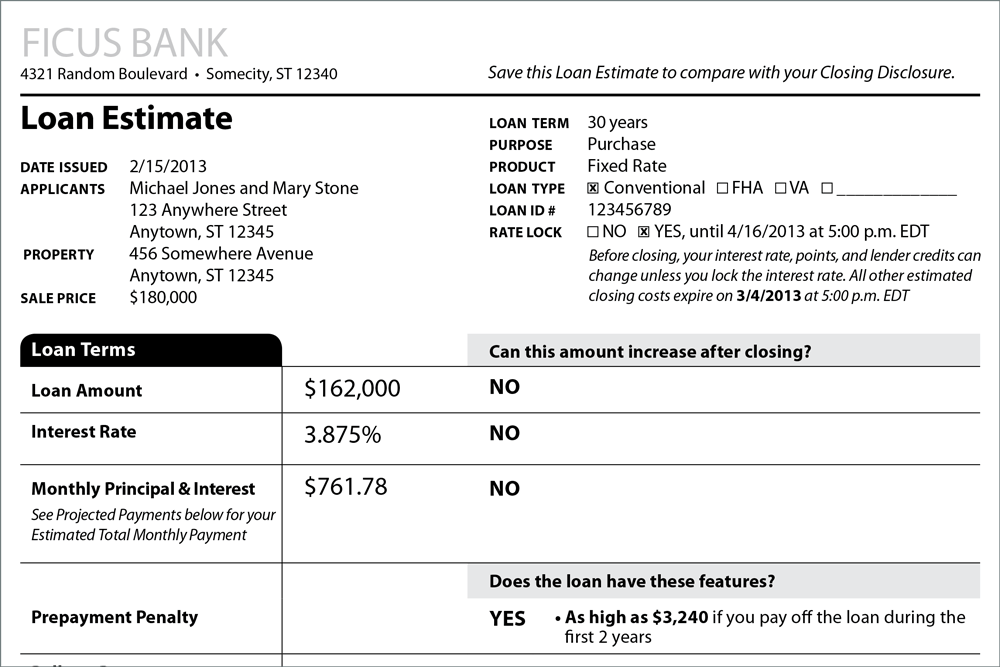

Loan Estimate Example

When a homebuyer receives a Loan Estimate, it should reflect a particular loan discussed with a lender.

Education

The Need for Electronic Collaboration: Solutions to Effectively Share Data for TILA-RESPA Integrated Disclosures

Don Partington of Fidelity National Title Group, Ethan Pack of Stewart Title and Steve Acker of Closergeist

5 Key Areas to Prime Your Operation for the New Closing Process

Cynthia Blair NTP, Blair Cato Pickren Casterline Shari Schneider, Stewart Title of California Sheila Strong, AmeriFirst Home Mortgage Leslie Wyatt, SoftPro

New Era In Closings Prepare Now for the CFPB's Integrated Mortgage Disclosures

The August 2015 implementation deadline for the Consumer Financial Protection Bureau's integrated disclosures will be here before we know it.

In the News

CFPB Issues TRID Factsheet on Disclosure of Title Insurance

The Consumer Financial Protection Bureau (CFPB) issued a factsheet addressing the disclosure of title insurance fees under the TILA-RESPA Integrated Disclosures Rule (TRID) on the Loan Estimate and Closing Disclosure.

Loans Not Covered by TRID

Implementation of the Consumer Financial Protection Bureau’s integrated mortgage disclosures is Aug. 1, 2015. Note that there is no stagger in the roll out.

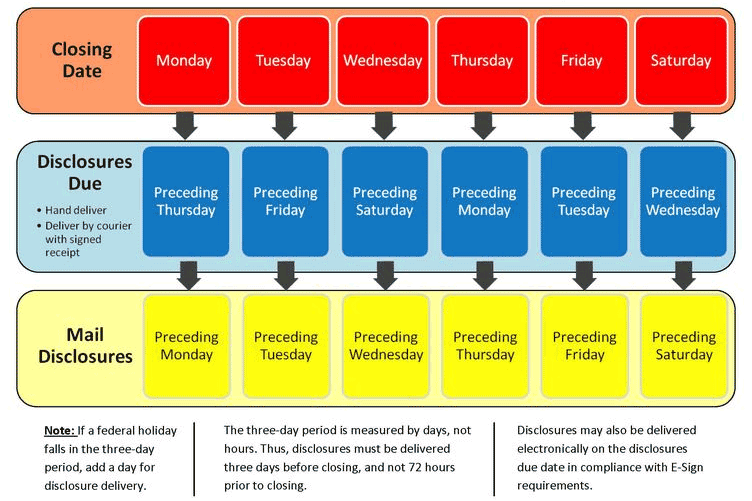

How to Comply with the Closing Disclosure's Three-day Rule

According to the Consumer Financial Protection Bureau’s final rule, the creditor must deliver the Closing Disclosure to the consumer at least three business days prior to the date of consummation of the transaction.

TRID Document Center

ALTA has developed standardized ALTA Settlement Statements for title insurance and settlement companies to use to itemize all the fees and charges that both the homebuyer and seller must pay during the settlement process of a housing transaction. Settlement statements are currently used in the marketplace in conjunction with the federal HUD-1. The ALTA Settlement Statement is not meant to replace the Consumer Financial Protection Bureau's Closing Disclosure, which went into effect on Oct. 3, 2015. Four versions of the ALTA Settlement Statement are available.

This information is not a substitute for legal advice, is for your reference only, and is not intended to represent the only approach to any particular issue. This information should not be construed as legal, financial or business advice, and users should consult legal counsel and subject-matter experts to be sure that the policies adopted and implemented meet the requirements unique to your company.