Endorsement Fees: To Include or Not to Include?

July 27, 2015

As title professionals handling closings become more familiar with the CFPB’s integrated mortgage disclosure forms, some questions have come up regarding disclosing endorsement charges. Since the final rule does not address endorsement charges and only speaks to disclosing the policy premium, there is no specific guidance as to how to disclose endorsements.

In following with the spirit of the rule, which promotes accurate disclosures to prevent any consumer confusion, it is best to disclose any endorsement fees separately on the disclosure forms. This approach applies to endorsement fees included in the lender’s premium as well as in the owner’s title policy calculation.

Endorsement fees should not be included in any policy premium disclosure computations to avoid consumer confusion as to the costs of their policies. Listing the endorsement fees separately from premium disclosures will better ensure that the consumer fully understands the closing transaction. Keep in mind that if the endorsement is wrapped into an enhanced policy you do not need to show the endorsement separately.

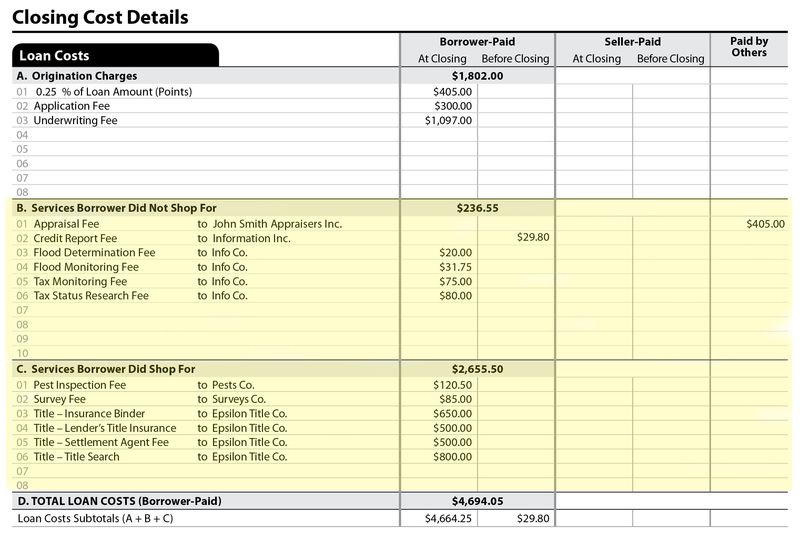

As a reminder, title fees will need to be structured this way on the Loan Estimate and Closing Disclosure: “Title – [description of fee]”.

As an example, an endorsement for the lenders policy--such as the PUD endorsement--would go under services you did or did not shop for depending on where the other title fees are appropriately disclosed: