CFPB Provides Analysis on How to Complete Closing Disclosure

January 24, 2017

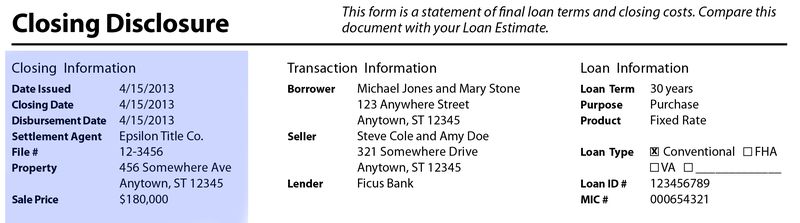

The Consumer Financial Protection Bureau on Nov. 18 hosted its fourth in a series of webinars addressing frequently-asked questions regarding the RESPA-TILA integrated mortgage disclosures. This webinar focused on the details of the Closing Disclosure form, which will take the place of the current HUD-1 and final Truth in Lending disclosure. The rule goes into effect Aug. 1.

Click here to listen to a recording of the webinar and download a copy of the presentation.

This webinar gave a detailed analysis of how to complete the Closing Disclosure form. Here are some points the CFPB discussed that may be particularly pertinent to members of the title insurance and settlement industry.

What date should be listed as the “Closing Date” under the rule?

- The term “closing date” can refer to different times in the transaction for different regions. The bureau declared that “Closing Date” for the purpose of the rule refers to the date of consummation, meaning “the time that a consumer becomes contractually obligated on a credit transaction.” (§ 1026.2(a)(13))

- The bureau’s Official Interpretation to the definition of “Closing Date” recognizes that “[w]hen a contractual obligation on the consumer's part is created is a matter to be determined under applicable law; Regulation Z does not make this determination.” (§ 1026.2(a)(13)-1)

- When completing the Closing Disclosure form, use the consummation date where the forms request the Closing Date

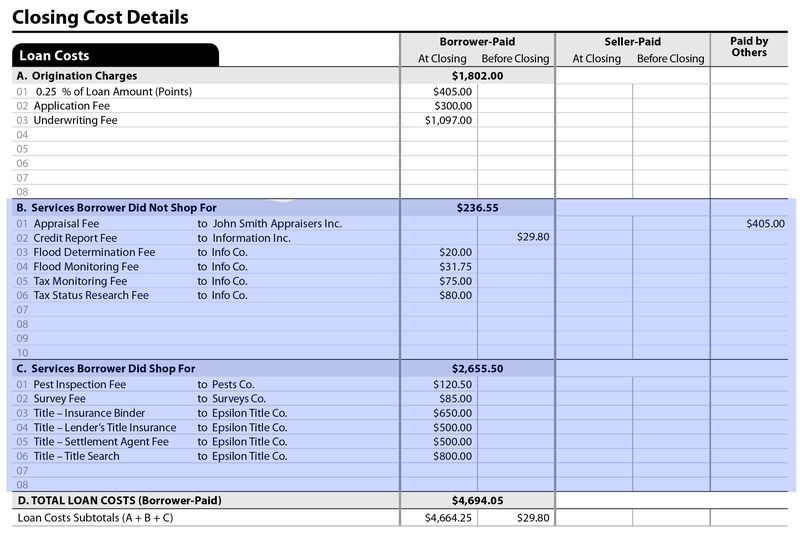

When should an item be disclosed as “Services Borrower Did Shop For” vs. “Services Borrower Did Not Shop For” on the Closing Disclosure form?

- The Bureau stated that an item that was disclosed as “Services You Can Shop For” on the Loan Estimate (§ 1026.37(f)(3)) will move into the “Services You Cannot Did Not Shop For” category on the Closing Disclosure form when the consumer chooses a provider on the written list provided by the creditor with the Loan Estimate for that item. (1026.38(f)(2))

- Alternatively, if an item is disclosed as “Services You Can Shop For” on the Loan Estimate was not on the written list provided by the creditor with the Loan Estimate for that item, such item will be disclosed as “Services Borrower Did Shop For” on the Closing Disclosure form. (§ 1026.38(f)(3))

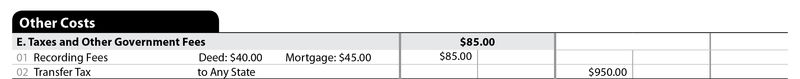

How should recording fees and transfer taxes be disclosed on the Closing Disclosure?

- The Bureau recognized that in some states, there will be several transfer taxes that will be part of the real estate transaction and the loan transaction

- Transfer taxes should be itemized on the Closing Disclosure instead of aggregated together as required for the Loan Estimate. (Review §1026.37(g)(1) and its subparts for the Loan Estimate requirements and § 1026.38(g)(1) and its subparts for the Closing Disclosure Requirements)

- Itemization is for each tax and for each governmental entity

- Name of government entity should be disclosed on Closing Disclosure form

- Similarly to the Loan Estimate, the Closing Disclosure form requires recording fees to be disclosed as one item. (§ 1026.37(g)(1)(i) and § 1026.38(g)(1)(i))

- However, the Closing Disclosure also requires that the amount paid to record the deed and mortgage be itemized separately.

- The itemized recording fees for the deed and the mortgage only need to include the amounts needed to record each of these documents

- Recording fees for other documents, except for the deed and the mortgage, are just included as part of the total recording fees and do not need to be itemized

- Creditors should disclose the name of the entity assessing the transfer tax, even if that entity is different from the payee of the check cut by the settlement agent. (§ 1026.38(g)(1)(ii))

Are creditors permitted to include additional forms if the information required to be disclosed does not fit in the space allotted on the form?

- The answer to this question depends on the provision of the rule under which the creditor wishes to use such additional disclosure forms

- Creditors must look to each provision of § 1026.38 to determine whether the use of addendums are permitted by the rule

- The rule does permit the use of additional pages “for the purpose of including customary recitals and information used locally in real estate settlements.” (§ 1026.38(t)(5)(ix)) As examples of when an additional page may be used to disclose customary recitals and information used locally in real estate settlements, the Bureau listed “a breakdown of payoff figures, a breakdown of the consumer's total monthly mortgage payments, check disbursements, a statement indicating receipt of funds, applicable special stipulations between buyer and seller, and the date funds are transferred.” (§ 1026.38(t)(5)(ix)-1)

- The Bureau has not created a model form or sample of an addendum. The Bureau has only indicated that the additional forms should be formatted similarly to the disclosure form itself and that creditors not use any more additional pages than are necessary. Any additional pages that may be included should “not affect the substance, clarity, or meaningful sequence of the disclosure.” (§ 1026.38(t)(5)-1)