Featured Resources

Study

Study

Cybercrime & Wire Fraud Study

ALTA members have access to results of the Cybercrime & Wire Fraud Study sponsored by the ALTA Land Title Institute.

ALTA Insights Webinar

ALTA Insights Webinar

Why Cyber Insurance is Non-negotiable for the Title Industry

Get a deep dive into the topics of cyber liability coverage and exclusions, new safeguard data security requirements and important security regimes.

Template

Template

ALTA Cybersecurity Incident Response Plan

Use this tool to help your team to establish and maintain secure systems and be prepared to act quickly if an incident occurs.

In the News

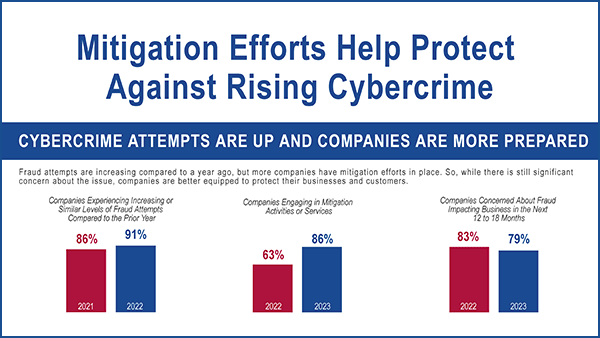

Survey: Title Companies Report Increase in Cyberattacks But Mitigation Efforts Help

More than 90% of title insurance companies reported the volume of cybercrime attempts increased or remained the same over the past year, according to a Cybercrime & Wire Fraud Study sponsored by the ALTA Land Title Institute.

Cybersecurity Advisory from ALTA's Information Security Work Group

ALTA's Information Security Work Group urges everyone to use extreme caution when opening emails containing links, attachments or requests for personal information, such as security credentials or authentication codes. Read on for additional guidance to improve cybersecurity protocols.

3 Common Misconceptions About Password Security

Everyone knows that choosing a strong password is a critical step in securing the various systems and accounts we all use daily. However, you may be surprised to learn that some commonly held beliefs about passwords are more harmful than helpful.

Policy + Tools

ALTA Cyber System Overview

Use this narrative to improve your understanding of a Cyber System Inventory, why it is important to Cybersecurity efforts, and how to create and maintain your company's inventory.

ALTA Business Impact Analysis

Use this guide to examine your software applications, determine which resources are critical to your operation, and discover when to add resources to minimize the business impact of downtime.

ALTA Cyber System Inventory Workbook

Use this model workbook to create and customize your company's inventory.