There's more bad news for retirement security following the coronavirus pandemic.

Social Security's trust funds could run out four years earlier — in 2032 rather than 2036 — based on how well the economy recovers, according to a new report from The Wharton School at the University of Pennsylvania.

How quickly those funds could be depleted depends on whether there is a so-called U-shaped or V-shaped recovery. A V-shaped downturn would come with a quicker recovery and would mean the trust funds may last until 2034.

Yet hopes for a quick bounce back could be optimistic.

"Our best guess is the U shape," said Kent Smetters, faculty director of the Penn Wharton Budget Model, a nonpartisan research organization at the school.

More from Personal Finance:

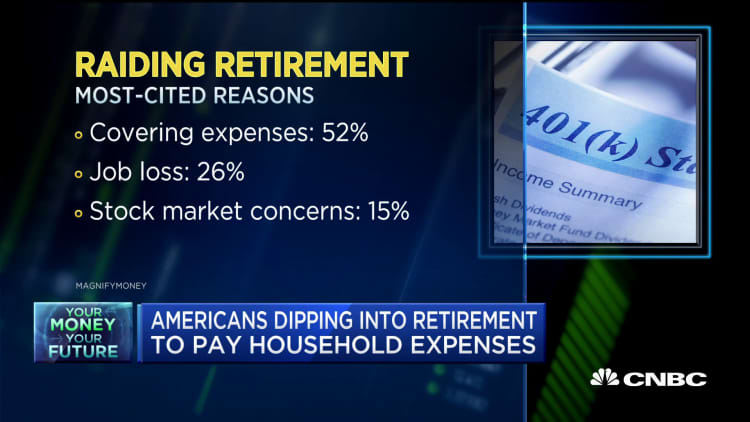

Americans reluctant to raid their Social Security to cover pandemic expenses

Costs have skyrocketed for retirees. Why Social Security benefits aren't keeping up

Unemployed and eligible for Social Security? Here's what you need to know

The Social Security Administration recently released its own projections for the Old-Age and Survivors Insurance and Disability Insurance trust funds. But that estimate did not factor in the effects of the coronavirus.

The agency estimated that the funds would be depleted by 2035, in keeping with last year's estimate. However, only 79% of promised benefits will be payable at that time, down from 80% in its previous projection.

The pandemic will reduce the amount of money going into Social Security in several ways, according to the researchers at Wharton.

There will be less money collected through payroll taxes because millions of workers have lost their jobs. The trust funds' interest income also will be reduced because of lower interest rates. Meanwhile, low inflation may mean lower earnings for workers and therefore less taxes paid into the system.

The coronavirus will also reduce Social Security's costs in several ways, which isn't necessarily good news for retirees. That would be from higher mortality rates, lower annual cost-of-living adjustments and reduced benefits claimed at retirement.

"Congress presumably will use this information to act, to try to figure something out," Smetters said. "But that is the path we're currently on."

Admittedly, lawmakers' choices could be more limited than they were in 1983, when Congress last made major changes to Social Security. At that time, payroll taxes were increased and benefits were reduced by raising the retirement age.

Now, payroll taxes are already higher and moving the retirement age to as high as 70 or over would not do as much to improve the trust fund exhaustion date, Smetters said.

For people who are planning their retirement, that means they should factor in a haircut to their benefits, Smetters said.

"It never hurts to save a little bit more and make up for the potential shortfalls," Smetters said.