While lenders have long touted the value have having the originator of a mortgage loan attend the closing, a recent analysis from STRATMOR Group uncovered added benefits.

While lenders have long touted the value have having the originator of a mortgage loan attend the closing, a recent analysis from STRATMOR Group uncovered added benefits.

According to STRATMOR Group’s Insights report for August 2016, originators should attend the closing if for no other reason than potential sales and marketing benefits that come from meeting the realtor and buyer. But for the originator, there is also the benefit of potential contact with the seller.

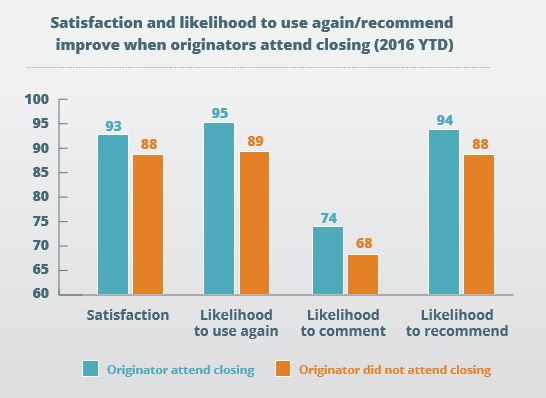

The data collected from STRATMOR’s MortgageSAT Borrower Satisfaction Program (year-to-date in 2016 through July) showed that not only does borrower increase by 7 percent when the 0riginator attends the closing, but the “Likelihood to Use Again” category also went up.

The buyer was also more likely to recommend the lender (primarily to family and friends) and more likely to comment favorably on social media when the originator was present during the closing, according to the analysis.

“The increase in borrower satisfaction when the originator attends the closing also hints at one reason why Borrower Satisfaction for the Retail Channel is higher than for the Consumer Direct Channel, for which loan originators are tied to a call center and cannot attend the Closing,” the report stated.

“The increase in borrower satisfaction when the originator attends the closing also hints at one reason why Borrower Satisfaction for the Retail Channel is higher than for the Consumer Direct Channel, for which loan originators are tied to a call center and cannot attend the Closing,” the report stated.

The analysis from STRATMOR found that while there is a theoretical cost associated with loan originators attending closings, originators who closed an average of three to five loans per week it ended up using up an average of only about 5 to 10 percent of their available hours, assuming a 40-hour work week.

“Based on these findings, it appears that requiring retail loan originators to attend their loan closings is likely to be very cost effective—and it requires virtually no capital investment,” the report stated. “Originator attendance at loan closings can have a positive impact on borrower satisfaction with potential marketing and sales benefits. To us, this is a ‘low hanging fruit’ opportunity.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news