The two mortgage financing companies that received whopping government bailouts in the financial crisis are on the verge of paying it all back.

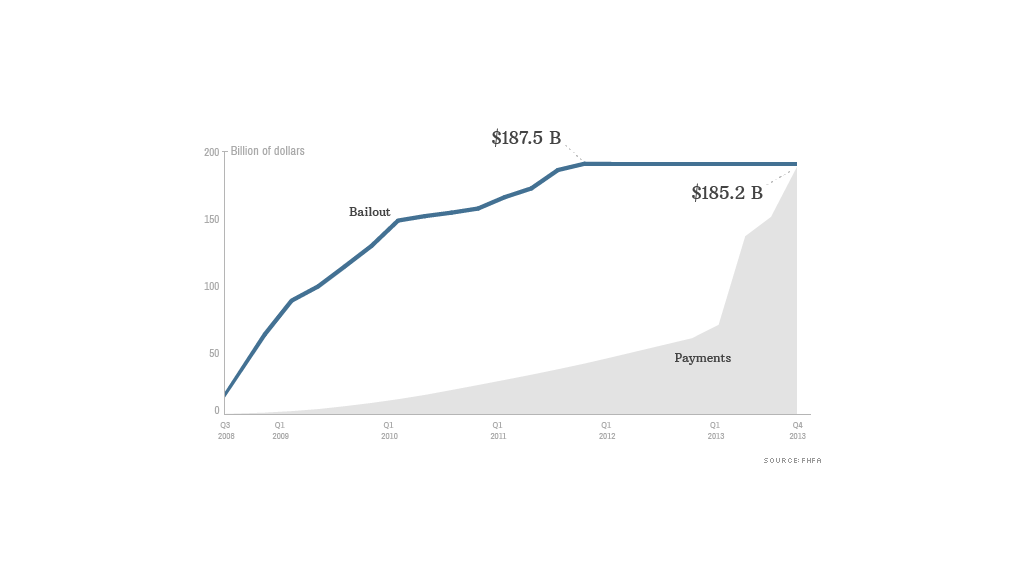

Later this month, Fannie Mae and Freddie Mac are likely to report earnings that will result in them paying the U.S. Treasury more than the $187 billion they received starting in 2008.

Since the beginning of last year, Fannie and Freddie have been turning over virtually all profits to the government each quarter. Before that, they were paying a 10% dividend on the preferred stock held by Treasury.

That change has meant a windfall for Treasury, which controls 80% of each company's stock.

A recovery in the housing market, coupled with accounting rules that produced huge one-time gains at both firms last year, also resulted in much larger payments.

As a result, Fannie and Freddie paid $130 billion to taxpayers last year alone, after paying only $55 billion from 2008 through 2012.

Related: Treasury closes books on GM bailout with final stock sale

While 2013's payments are unlikely to be matched this year or any time soon, the firms are likely to keep paying billions to Treasury in dividends, quarter after quarter, unless there is another sharp downturn in the housing market or Congress moves ahead with proposals to phase out both firms.

If the government hadn't changed the repayment rules, it would probably have been another six years before taxpayers could hope to recoup the billions the firms received.

Neither Treasury nor the firms will comment about the payments to taxpayers ahead of the fourth-quarter financial results. Since their combined dividends are only $2 billion below the original bailout amount, passing that threshold this quarter is virtually certain.

Related: We're almost break even on the bailouts

But not everyone is happy about the prospect of taxpayers being made whole for the rescue of the firms. In fact, there are two federal lawsuits challenging the current repayment schedule.

In one suit, hedge fund Perry Capital argues that the larger repayment violates the 2008 law that authorized the bailout. They contend that if profits are being returned to taxpayers, the government should give up some shares in return. That would increase the value of the shares held by private investors, including Perry Capital, that account for 20% of the firms' stocks.

Other private investors, who bought Fannie and Freddie before the housing bust, include community banks, pension funds, university endowments and foundations.

The other suit is brought by low-income housing groups, led by the Right to the City Alliance. They argue that the original bailout law also demanded that a fraction of future Fannie and Freddie profits go into a government trust fund set up to provide affordable housing to the low income and homeless.

But Rachel Laforest, the alliance's executive director, said that no money has ever gone into the fund. The suit estimates that if the law had been followed there would be $578 million now in the fund, and hundreds of millions a year in future contributions.