Debt-Ceiling Crisis Could Wallop the Housing Sector

The real-estate market is slowly getting better, but if Congress doesn't act in time, mortgage rates could soar

It's tough to see, given the onslaught of brutal economic and political news that has dominated recent headlines, but Thursday actually brought a sliver of good news about the beleaguered housing market: The National Association of Realtors reported that its measure of pending home sales climbed by 2.4 percent in June, followed a strong but oft-forgotten 8.2 percent rise in May.

Thursday's report surpassed the Bloomberg consensus forecast for a 2 percent drop. But despite the signs of new life in the housing market, potentially terrible news looms on the horizon. If Congress and President Obama can't find agreement on raising the nation's borrowing limit, the housing sector could suffer another big hit.

MORE FROM NATIONAL JOURNAL:

Countdown to the Vote: Who's With Boehner?

No Way Out? Five Keys to a Debt Deal

Beneath Clash Over Debt, a Divided Public

Housing remains the economy's most troublesome problem child. Unlike consumer spending and hiring, which each surged briefly during this slow-and-go recovery, housing has stayed in near free-fall (except for the period when federal tax credits were propping it up artificially) throughout the country since the financial crisis.

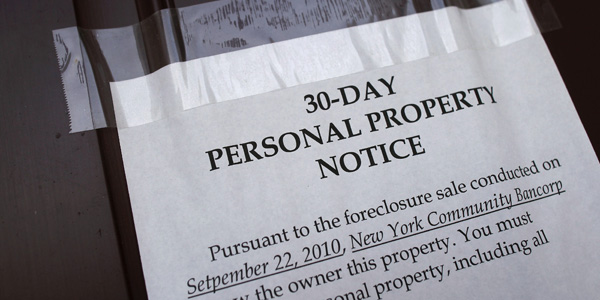

Home prices continued to fall, year over year, in the Case-Shiller numbers released this week. Home sales and home-building levels remain extremely depressed, and with them, employment in real estate and construction. A glut of foreclosures continues to clog the market.

Those problems figure to compound under almost any scenario in which lawmakers fail to raise the debt ceiling in time. If the government defaults on its debt, or if rating agencies downgrade its credit score, interest rates figure to soar--and likely, mortgage rates with them.

Equally troublesome is the possibility of the federal government prioritizing its bills, having run out of borrowing authority, and skipping payments to contractors, government workers, or beneficiaries of social programs such as Medicare or Social Security--leaving a lot of Americans with a lot less money to buy a house or make a mortgage payment.

Analysts' estimates of how much that would hurt the market range from "a bit" to "a ton."

"If Congress fails to raise that ceiling then the U.S. housing market would most likely experience a severe double-dip contraction marked by much lower home sales and depressed house prices," Christian E. Weller, a senior fellow at the liberal Center for American Progress, wrote in a white paper earlier this year. "That, in turn, would spark a return of the economic pain of the past few years for many families as foreclosures would remain at or near record highs, and jobs in key sectors, such as construction, would disappear again."

Mark Calabria, a housing expert at the free-market Cato Institute, predicts a price decline from increased interest rates would "be minor, no more than 5 percent." The length of the impasse beyond the drop-dead date of August 2 is key, he added.

"Anyone with any sense has already decided not to close on their mortgage on either August 2 or 3. Or to go mortgage shopping those dates. So if this lasts less than a week, then the impact will be relatively short lived."

Image credit: Larry Downing/Reuters